Upstox as a stock trading platform offers users the opportunity to invest in a wide range of stocks and exchange-traded funds (ETFs). It was founded to democratize access to the stock market and make investing accessible to everyone.

Through Upstox, users can create and manage their investment portfolios with ease, regardless of their level of expertise or experience in the stock market. The platform offers a range of features and tools to help users make informed investment decisions, including real-time market data, charting tools, and news and analysis.

Upstox was founded in 2011 and is headquartered in Mumbai, India. The company is regulated by the Securities and Exchange Board of India (SEBI) and is a member of major stock exchanges in India such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

When it comes to comparing Upstox to other stock trading platforms, there are a few key differences to consider. For one, Upstox offers commission-free trading for all users, whereas many other platforms charge fees for trades. Additionally, their social trading platform is a unique feature not available on many other platforms.

Table of Contents

Features and Benefits of Upstox:

Upstox offers a range of features and tools designed to help traders make informed investment decisions and manage their portfolios with ease. Some of the key features and benefits of Upstox are as follows:

- Commission-Free Trading – Upstox offers commission-free trading for all users, meaning that traders can buy and sell stocks and ETFs without incurring any fees. This can result in significant cost savings over time, especially for active traders.

- Real-Time Market Data – It provides users with real-time market data, allowing them to stay up to date on the latest market trends and make informed investment decisions.

- Social Trading – The platform’s social trading platform allows users to follow and copy the trades of other successful traders on the platform. This can be a valuable tool for novice traders looking to learn from more experienced investors.

- Customizable Watchlists – It allows users to create customizable watchlists of stocks and ETFs, making it easy to keep track of investments and monitor changes in the market.

- Advanced Charting Tools – The platform provides detailed stock charts and advanced charting tools, allowing users to analyze historical trends and make informed investment decisions.

- Low Minimum Investment – It has a low minimum investment requirement of just $5, making it accessible to traders of all levels.

Traders have used Upstox to improve their trading strategies in a variety of ways. For example, some traders have used the social trading feature to learn from and mimic the trades of successful investors. Others have used the platform’s real-time market data and advanced charting tools to make more informed investment decisions.

How to open an account:

To open an account with Upstox you can follow the following steps:

- Click on the “Sign Up” button on the website.

- Provide your details such as your name, email address, and contact number.

- Generate a unique username and password to set up your account.

- Provide additional information, such as your employment status, income, and investment experience.

- Complete the identity verification process by providing a copy of your government-issued ID.

- Fund your account by linking your bank account or by transferring funds via wire transfer.

- After depositing funds into your account, you can begin trading on the platform.

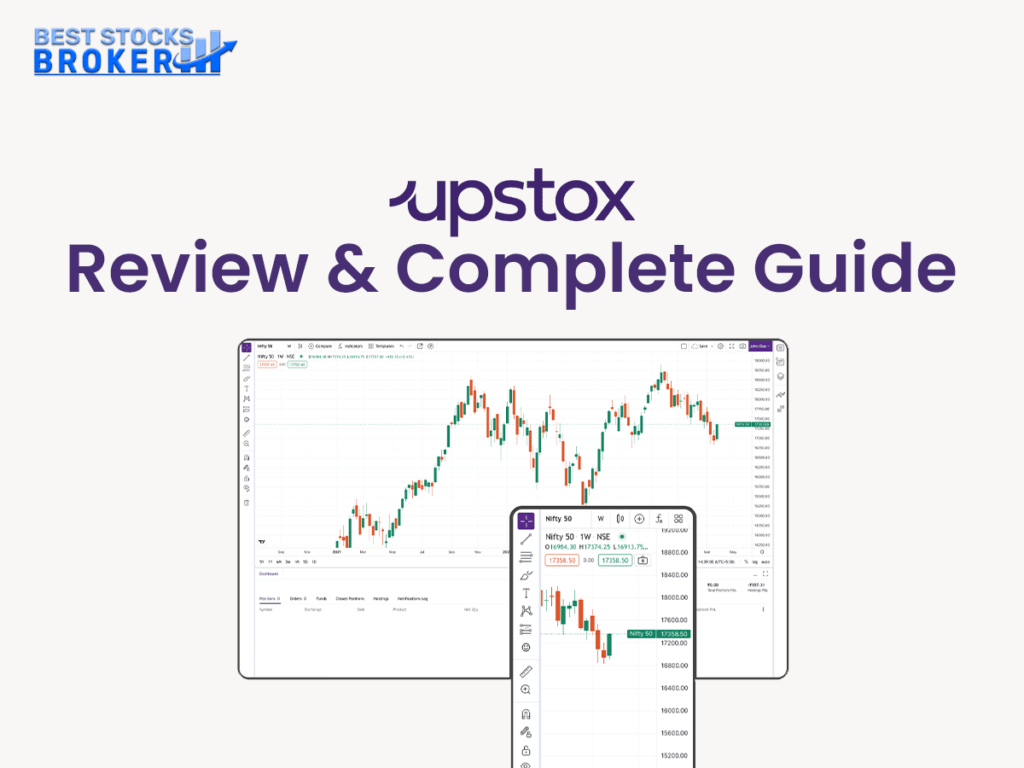

User Interface

Upstox’s user interface is designed to be intuitive and user-friendly, making it easy for traders of all levels to navigate the platform’s features and tools. Here is an overview of the platform’s user interface, as well as a step-by-step guide on how to navigate its features.

- Dashboard – Their dashboard is the first screen users see when they log in to the platform. It provides an overview of the user’s portfolio, as well as real-time market data and news updates.

- Navigation Bar – The navigation bar is located at the top of the screen and allows users to access different sections of the platform, including the trading dashboard, watchlist, account settings, and more.

- Trading Dashboard – The trading dashboard is where users can buy and sell stocks and ETFs. It includes real-time market data, advanced charting tools, and the option to create customized watchlists.

- Watchlist – The watchlist is where users can keep track of stocks and ETFs, they are interested in. Users can create multiple watchlists and customize them according to their preferences.

- Account Settings – The account settings section allows users to manage their account information, including personal details, banking information, and security settings.

Step-by-Step Guide:

- Log in to your account and navigate to the dashboard.

- Use the navigation bar to access different sections of the platform, such as the trading dashboard and watchlist.

- To buy or sell stocks or ETFs, navigate to the trading dashboard, and use the search bar to find the investment you are interested in.

- Use advanced charting tools to analyze historical trends and make informed investment decisions.

- Customize your watchlist by adding and removing stocks and ETFs as needed.

- Manage your account settings by navigating to the account settings section and updating your personal and banking information as needed.

Pricing and Plans

Upstox pricing and plans in India are as follows:

- Account opening fee: It does not charge any account opening fee.

- Commission fees: There are no commissions charged on trades.

- Account maintenance fee: It does not charge any account maintenance fee.

- Inactivity fee: There are no inactivity fees charged by the platform.

For equity delivery trading, it levies a brokerage fee of Rs 20 or 2.5% of the transaction value (whichever is lower), and Rs 20 or 0.05% for equity intraday, equity futures, currency futures, and commodity futures trading. The business levies a flat brokerage cost of Rs 20 for options.

Compared to traditional brokers that charge commissions per trade, Upstox’s pricing in India is highly competitive. Indian investors can invest in a wide range of US stocks and ETFs without having to worry about commissions or account minimums. It makes them an accessible platform for both beginner and experienced investors.

The value and benefits of Upstox, its pricing and plans in India are evident in its user-friendly interface, educational resources, and variety of investment options. Indian investors can access the US stock market through their platform without worrying about hidden fees or commissions.

Security and Regulation

Upstox takes security and regulatory compliance very seriously, implementing a range of measures to protect its users’ data and transactions. The platform is registered with the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), ensuring that it operates within the framework of applicable laws and regulations.

The platform uses bank-level encryption to protect user data and transactions and two-factor authentication to prevent unauthorized access to accounts. The platform also employs regular security audits and risk assessments to identify and address potential vulnerabilities.

It has a strong reputation and is generally considered to be a trustworthy and reliable platform in the stock trading community. Its compliance with regulatory requirements and robust security measures have helped build trust among users. The platform has received positive reviews for its user-friendly interface and commission-free trading.

Customer Support

Upstox offers customer support through several channels, including email, phone, and live chat. Traders can also access a comprehensive Help Center on their website that includes articles and FAQs on a variety of topics.

In terms of response time, their customer support is generally considered to be efficient and effective. Most customer inquiries are resolved within 24 hours, and the live chat option allows traders to quickly connect with a support representative for immediate assistance.

The platform has also received positive reviews from users about its customer support. Many traders have praised the platform’s responsive and helpful support team, who are knowledgeable about the platform’s features and able to provide timely solutions to issues.

Conclusion

Thus, Upstox is a user-friendly and affordable stock trading platform that offers commission-free trading and a range of useful features and tools. Its low minimum investment requirement and intuitive user interface make it accessible to traders of all levels, while its security measures and regulatory compliance combined with its strong reputation and positive customer support experiences, further solidify its position as a reliable and trustworthy platform.

FAQs about Upstox

Can I Trade Penny Stocks on Upstox?

No, Upstox does not support the trading of penny stocks.

Does Upstox offer a Mobile App?

Yes, Upstox offers a mobile app for both iOS and Android devices.

How long does it take to open an account with Upstox?

Opening an account with the platform takes only a few minutes, and the process can be completed entirely online.

Does Upstox offer Margin Trading?

No, Upstox does not currently offer margin trading.

Does Upstox offer a paper Trading Account for Practice?

Yes, it offers a free paper trading account for users to practice trading without risking real money.

How does Upstox make money if it offers Commission Free Trading?

The platform generates revenue through other means, such as interest on uninvested cash and securities lending.

Does Upstox offer automatic investing or Robot Advisory Services?

No, Upstox currently does not offer automatic investing or robot-advisory services.

Can I transfer my account from Another Brokerage to Upstox?

Yes, you can transfer your account from another brokerage using ACATS (Automated Customer Account Transfer Service).

What is Upstox’s policy on Fractional Shares?

Upstox supports trading in fractional shares, allowing users to invest in stocks and ETFs with small amounts of money.

Are there any account minimums on Upstox?

No, the platform has no account minimums, meaning traders can invest small amounts of money without worrying about meeting a certain threshold.